illinois taxes due date 2021

Week of May 23 2022. No filing extensions are.

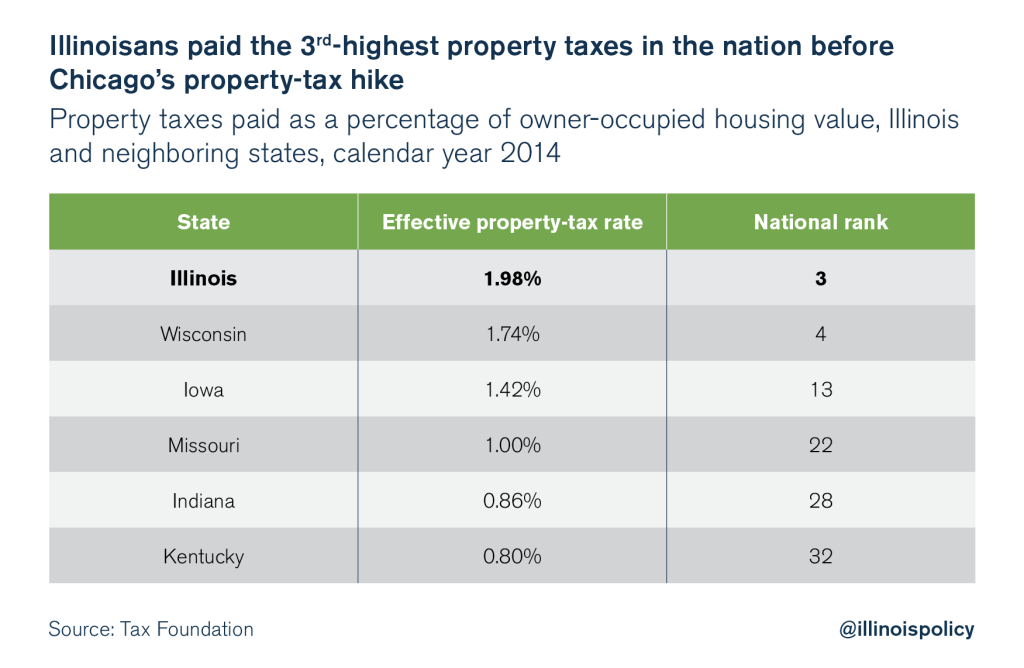

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

WLS -- Illinois has pushed back its state tax filing deadline to May 17 matching the change by the IRS.

. 090522 LABOR DAY - OFFICE CLOSED. The mailing of the bills is dependent on the completion of data by other local. 090122 2nd installment due date.

2021 Real Estate Tax Calendar payable in 2022 May 2nd. Annual Tax Sale -. Administration of refunds resulting from duplicate payments of the same taxes overpayments of taxes due or reductions in assessments after original billing as.

Welcome to Johnson County Illinois. Employers must file wage reports Form UI-340 and pay contributions in the month after the close of each calendar quarter - that is on or before April. Illinois Extends Income Tax Filing Deadline Pritzker Announces The extension does not apply to estimated tax payments due on April 15 2021 according to Pritzkers office.

Has yet to be determined. 2021 Real Estate Tax Collection dates 2022. The due dates are.

Although the Bulletin addresses calendar. Q2 Apr - Jun July 20. 1st installment - Friday August 6 2021.

The Bulletin provides that the extended due date for calendar-year 2021 Form IL-1120 returns is November 15 2022. Mail Tax Bills. The 2021 pay 2022 Real Estate taxes-Will be in the mail May 25th 2022.

For tax year 2021 the filing deadline for Illinois income tax returns of taxpayers affected by tornadoes in December 2021 has been extended from April 18 2022 to May 16 2022. By law Monday October 17 2022 was the last day to submit information to receive the Illinois Income Tax Rebate and Property Tax Rebate Public Act 102-0700. 1st installment due date.

15 penalty interest added per State Statute. ALL DATES ARE TENTATIVE UNTIL FURTHER NOTICE. Tax Year 2021 Second Installment Property Tax Due Date.

Q1 Jan - Mar April 20. 2nd installment - Friday September 17 2021. 2020 payable 2021 Property Tax Due Dates.

090222 Per Illinois State Statute 1½ interest per month due on late payments. 111722 Property Tax Sale. Property tax bills mailed.

June 27th 2022 for the 1st installment and September 6th 2022 for your 2nd installment. Governor JB Pritzker announced Thursday the state.

Us Tax Deadlines For Expats Businesses 2022 Updated Online Taxman

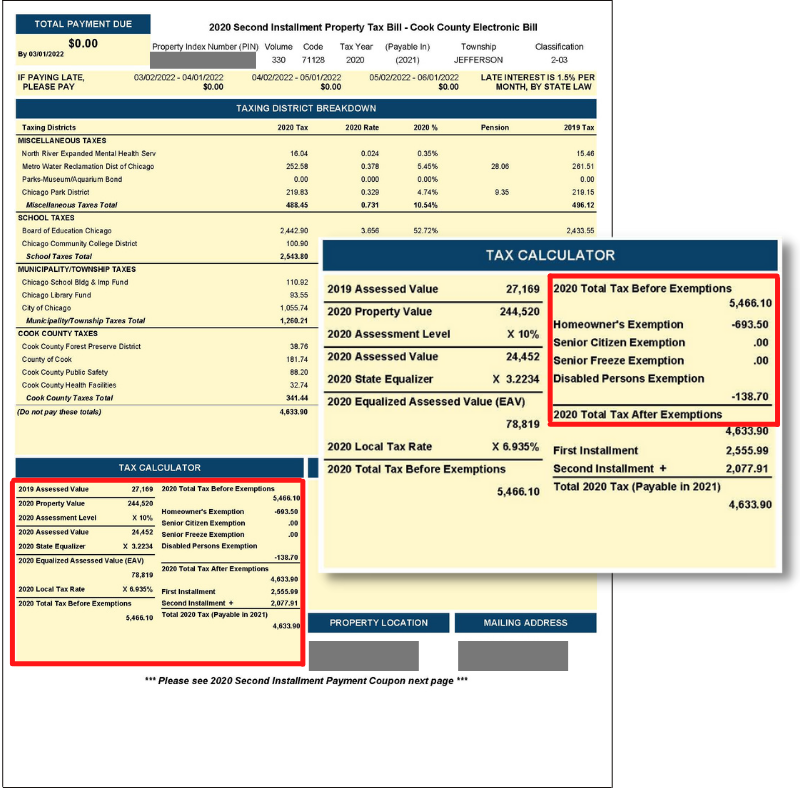

The Perfect Storm 2021 Property Taxes And Chicago Community Associations The Ksn Blog

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

2022 Illinois Tax Filing Season Begins Monday Khqa

Illinois Requires Remote Sellers And Marketplaces To Collect Local Sales Tax Starting January 2021

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Illinoisans Can Submit State And Federal Tax Returns Starting January 24

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Where S My Refund Illinois H R Block

Assessor S Office Lemont Township

Welcome To The Illinois Department Of Revenue

Ildeptofrevenue Ildeptofrevenue Twitter

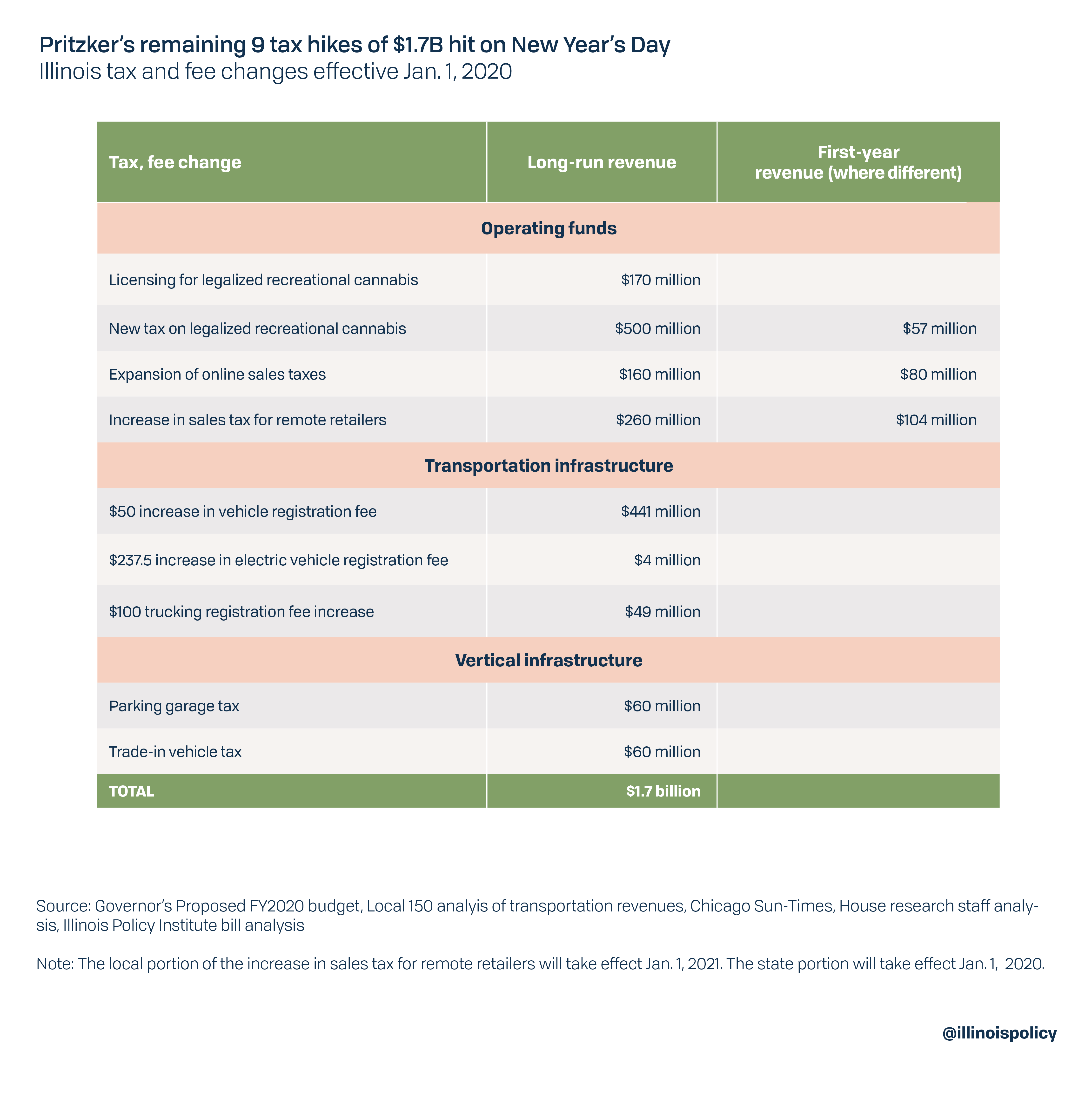

9 New Illinois Taxes Totaling 1 7b Take Effect Jan 1

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Tax Day Is Coming Soon Here S What You Need To Know About Filing Your 2021 Taxes Chicago News Wttw